401k withdrawal tax calculator fidelity

Monthly withdrawals are estimated by calculating the hypothetical withdrawal a portfolio may support in a poor market condition. For traditional 401 ks there are three big consequences of an early withdrawal or cashing out before age 59½.

/401k_clipboard_form-5bfc31724cedfd0026c22a74.jpg)

Can I Access Money In My 401 K If I Am Unemployed

Taxes will be withheld.

/retirement_tips_how_to_choose_the_best_traditional_ira_custodian-5bfc36af46e0fb002603f284.jpg)

. Using this 401k early withdrawal calculator is easy. Fidelity Investments - Retirement Plans Investing Brokerage Wealth. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis.

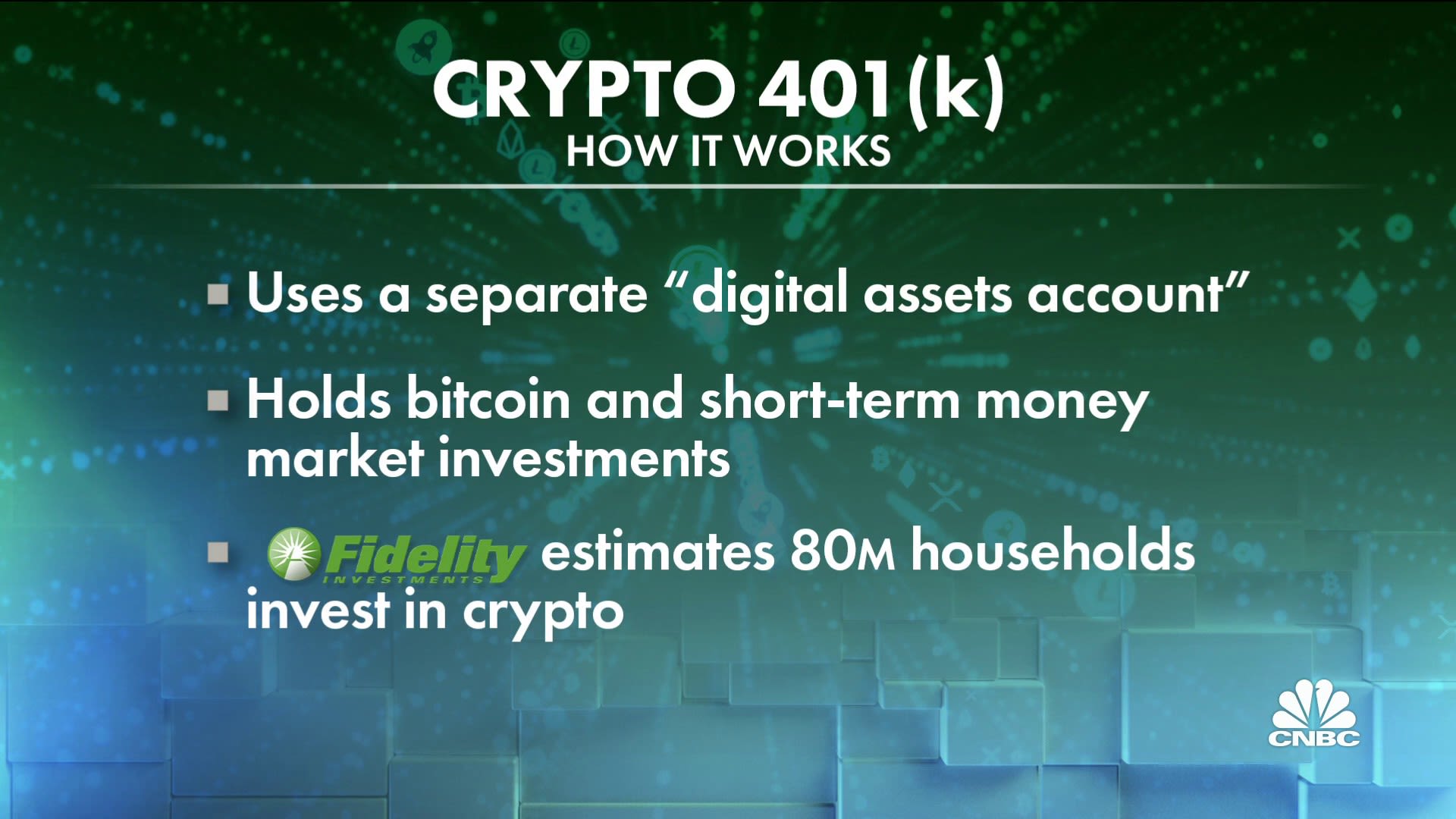

A 401 k can be one of your best tools for creating a secure retirement. This tool is great for. 401k withdrawal calculator fidelity Friday September 9 2022 While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some.

If you remove funds from your 401 k before you turn. This simple retirement calculator helps to estimate retirement income. First all contributions and earnings to your 401.

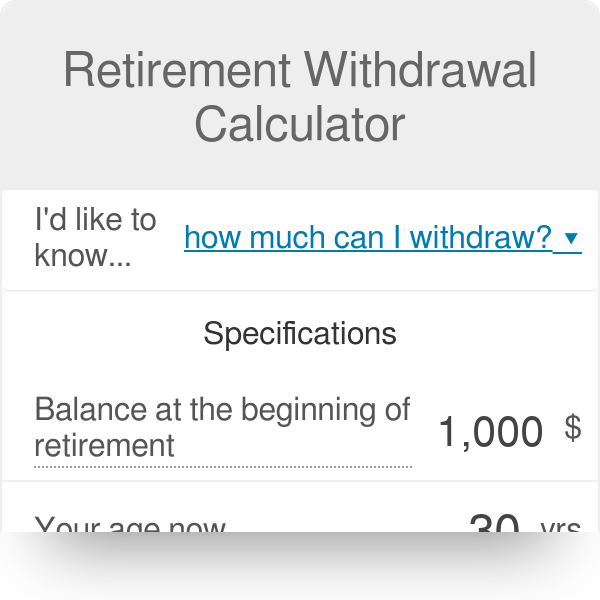

If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. May be indexed annually in 500 increments. The payroll taxes collected may not be enough to pay.

It provides you with two important advantages. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place. Also you should remember that the results you.

Use this calculator to estimate how much in taxes you could owe if. 401k Withdrawal Calculator. Of course taxes will be due when you withdraw money from your Plan.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. With this tool you can see how prepared you may be for retirement review. After taking out 12950 in standard deduction his first 10275 of taxable income will be taxed at 10 the remaining 31400 or ordinary income at 12 and because of his.

The IRS then takes its cut equal to 10 of 16250 1625 reducing the effective net value of your withdrawal to 14625. Fidelity The 4 rule says that you can withdraw 4 of your savings in the first year and calculate subsequent. Average Covid-19-related 401 k withdrawal was 10000.

Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator. The IRS generally requires automatic. Use this free savings calculator to estimate your investment growth over time.

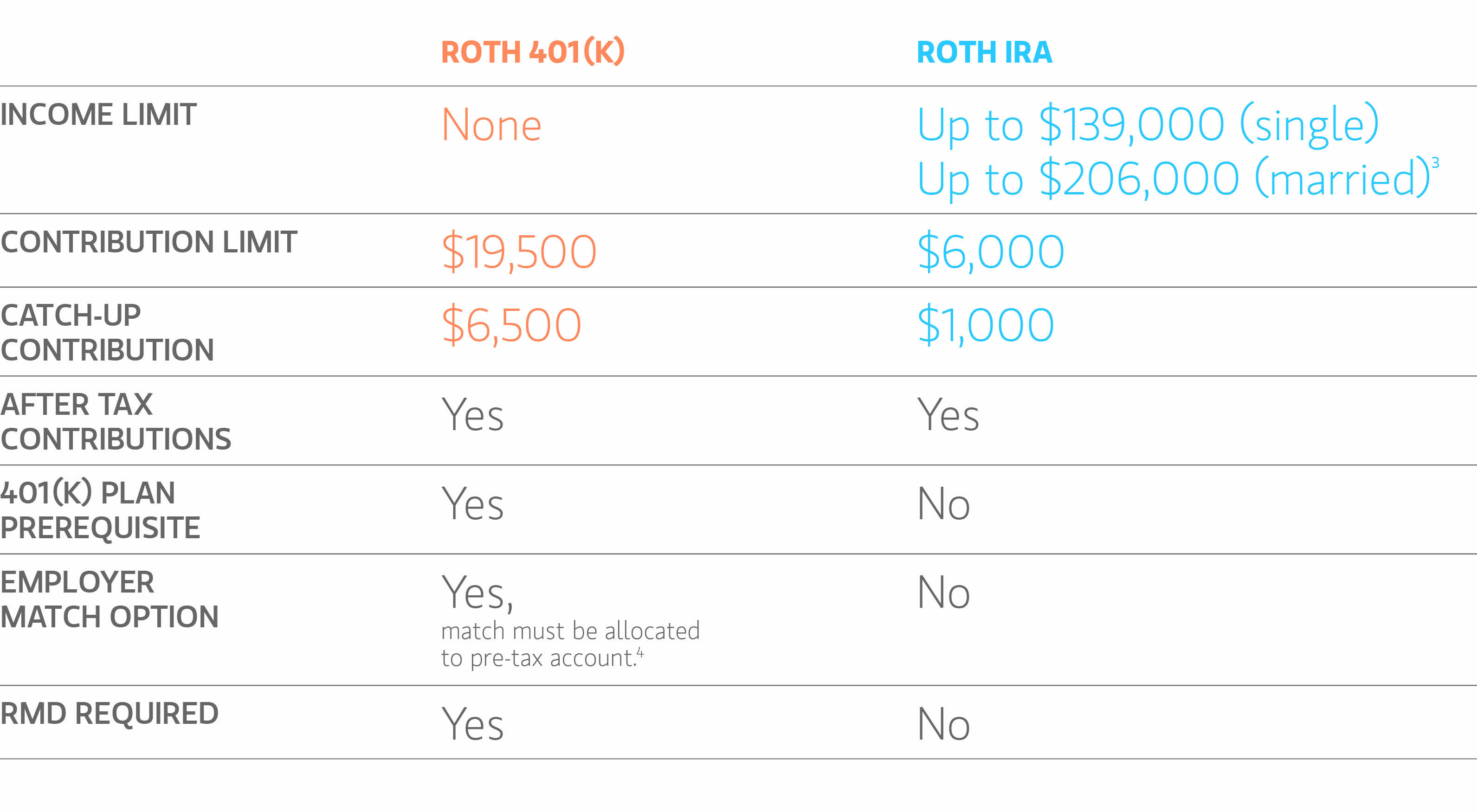

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax. 401k withdrawals are an option in certain circumstances. Pre-tax Contribution Limits 401k 403b and 457b plans.

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Choice Between Pre Tax And Roth 401 K Plans Trickier Than You Think

Retirement Withdrawal Calculator

Choice Between Pre Tax And Roth 401 K Plans Trickier Than You Think

401 K Inheritance Tax Rules Estate Planning

Taxes On 401k Distribution H R Block

Withdrawing 401k From India And The Associated Tax Implications Sbnri

The Average 401 K Balance By Age Income Level Gender And Industry

/retirement_tips_how_to_choose_the_best_traditional_ira_custodian-5bfc36af46e0fb002603f284.jpg)

How Are 401 K Withdrawals Taxed For Nonresidents

What Happens When You Inherit An Ira Or 401 K

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result For The Opt Saving For Retirement How To Plan 401k Plan

401 K Early Withdrawal Overview Penalties Fees

Do You Have To Report 401k On Tax Return It Depends

401 K Plan What Is A 401 K And How Does It Work

How Do I Calculate How Much Money Is Available For A 401 K Loan